in Russian

enlarge

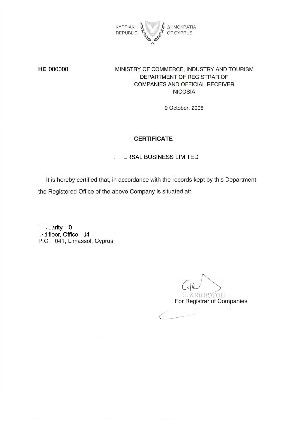

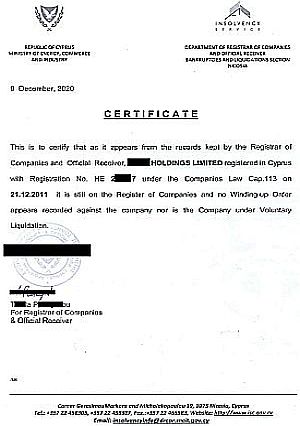

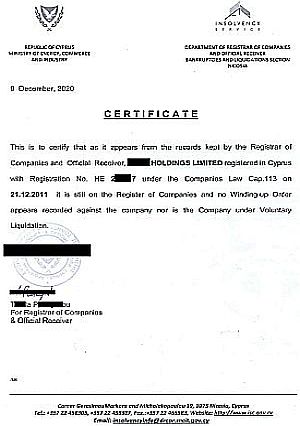

Text:

This certificate confirms that the company was struck off the register on such a specific date.

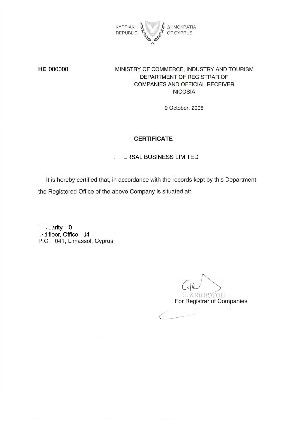

Apostille for Cyprus Certificate of Liquidation (Strike Off / Struck Off) or Bankruptcy

enlarge

Ministry of Energy, Commerce and Industry

Registrar of Companies and Official Receiver

This method is quite common, but it does not mean that the owner of the abandoned company will not face any consequences if the company has debts to third parties.

In the request, the Registrar asks for information about the company's activities and whether any activity is being carried out at all.

If no response is received within 1 month, the request is repeated.

If the company does not respond to the second request within 1 month, the Registrar publishes in the Official Gazette a notice of liquidation (striking off) of the company from the register. The same procedure is followed if the company responds that it is not operating.

In some cases, the Registrar may appoint an auditor.

1. A resolution of the company's shareholders to initiate the Strike off procedure and a letter addressed to the Board of Directors.

2. An application to the Registrar for the winding up of the company, in which all directors confirm that the company is not carrying on any business activity, with a request to strike off the Cyprus offshore company on the grounds that the company has ceased its business activity.

3. A statement signed by the directors that the company has no assets, debts and liabilities at the time of signing, that all bank accounts of the offshore company are closed, all previously issued powers of attorney have been revoked and cancelled, and all state fees, including strike-off fees, have been paid.

It is assumed that at the time of signing this document the company really

a) has no debts and assets;

b) all taxes, state fees, including VAT (if applicable) and the fee for striking off the company from the register have been paid; and

c) there are prepared financial statements

4. If the offshore company is managed and owned by a nominee director and shareholder - the decision of the beneficial owners to close the offshore company and sign a guarantee letter (Indemnity) for compensation for possible damages as a result of the nominee directors and shareholders performing their actions to close the company.

2. Publishes an announcement in the official newspaper of Cyprus that the company will be struck off the Register within three months from the date of publication of the announcement.

3. If during this time the Registrar does not receive any objections from the Cyprus Tax Authority, shareholders or creditors of the offshore company, then he sends the second and final notice to the registered office of the company.

4. Publication in the official newspaper of Cyprus that the company has been struck off the Register.

This entire procedure can take from several months to a year.

For this purpose, the company must undergo an audit and receive a corresponding conclusion.

To do this, any shareholder or creditor of the offshore company must apply to the court.

Our lawyer in Cyprus can both organize the liquidation of the company and restore it.

Certificate of Liquidation (strike off / struck off / dissolved) or bankruptcy of a Cyprus company

Can I order via 24GLO.com Certificate of Liquidation (strike off / struck off / dissolved) or bankruptcy of a company, registered in Cyprus?

Yes, you can. Just contact us.

What details do I need to provide to obtain a Cyprus Certificate of Deletion from the Cyprus Register?

You will need to provide us with the company name and/or registration number.

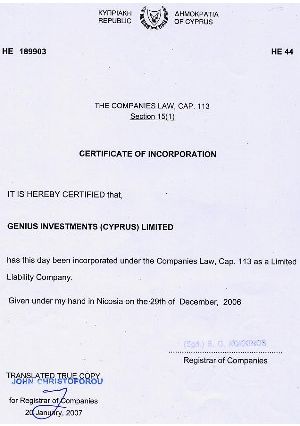

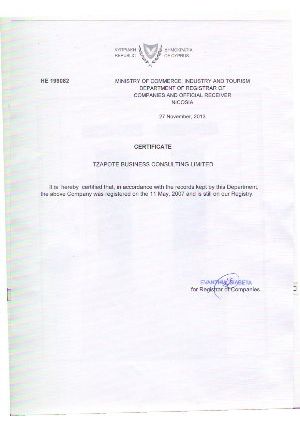

Examples and samples of the Certificate of liquidation (strike off / struck off) or bankruptcy

enlarge

Text:

This certificate confirms that the company was struck off the register on such a specific date.

Apostille for Cyprus Certificate of Liquidation (Strike Off / Struck Off) or Bankruptcy

enlarge

Which organization in Cyprus can issue a Certificate of Liquidation (Strike Off / Struck Off) or Bankruptcy

A bankruptcy certificate can only be issued by a government agency Cyprus:Ministry of Energy, Commerce and Industry

Registrar of Companies and Official Receiver

How much does a strike off / struck off certificate for a Cyprus company cost?

Official strike off / struck off certificate from the Registrar - no more than the average market price, in euros per certificate.

Time to receive a strike off / struck off certificate for a Cyprus company

The certificate can be received within 1 working day.

How can I receive the documents?

We will send the documents to any point in the world by courier service or by registered mail by Cyprus Post.

In what language can I issue a strike off / struck off certificate for a Cyprus company?

Certificates are issued in English or Greek.Can I order a strike off / struck off certificate online?

Yes, just send us the company name or number.Why a Cyprus company is automatically excluded from the register

Beneficiaries "abandon" the company to avoid liquidation costs. In this case, the abandoned organization stops filing annual reports and paying the necessary taxes and duties.This method is quite common, but it does not mean that the owner of the abandoned company will not face any consequences if the company has debts to third parties.

Cyprus Legislation for Strike-Off of a Company

According to the provisions of Article 327 of the Cyprus Companies law Chapter 113, an offshore company may be struck off from the Register of Active Companies at the initiative of the Registrar of Companies if there is a suspicion that the company is not carrying out economic activity.What is the procedure for striking a company off the register of Cyprus companies

If the company does not file an annual report (HE 32 form) for several years, the Registrar has reason to believe that the company is not carrying out any economic activity and the Registrar sends a request to it.In the request, the Registrar asks for information about the company's activities and whether any activity is being carried out at all.

If no response is received within 1 month, the request is repeated.

If the company does not respond to the second request within 1 month, the Registrar publishes in the Official Gazette a notice of liquidation (striking off) of the company from the register. The same procedure is followed if the company responds that it is not operating.

In some cases, the Registrar may appoint an auditor.

What happens to the assets of a company that is struck off the register

The property of a liquidated company, not encumbered by obligations, becomes the property of Cyprus.Who other than the Registrar can strike a company off the Cyprus register

The Strike off procedure can also be initiated on the basis of an application submitted by the directors of the company.1. A resolution of the company's shareholders to initiate the Strike off procedure and a letter addressed to the Board of Directors.

2. An application to the Registrar for the winding up of the company, in which all directors confirm that the company is not carrying on any business activity, with a request to strike off the Cyprus offshore company on the grounds that the company has ceased its business activity.

3. A statement signed by the directors that the company has no assets, debts and liabilities at the time of signing, that all bank accounts of the offshore company are closed, all previously issued powers of attorney have been revoked and cancelled, and all state fees, including strike-off fees, have been paid.

It is assumed that at the time of signing this document the company really

a) has no debts and assets;

b) all taxes, state fees, including VAT (if applicable) and the fee for striking off the company from the register have been paid; and

c) there are prepared financial statements

4. If the offshore company is managed and owned by a nominee director and shareholder - the decision of the beneficial owners to close the offshore company and sign a guarantee letter (Indemnity) for compensation for possible damages as a result of the nominee directors and shareholders performing their actions to close the company.

What happens when the application is received by the Registrar

1. The Registrar sends the first notice to the registered office of the offshore company2. Publishes an announcement in the official newspaper of Cyprus that the company will be struck off the Register within three months from the date of publication of the announcement.

3. If during this time the Registrar does not receive any objections from the Cyprus Tax Authority, shareholders or creditors of the offshore company, then he sends the second and final notice to the registered office of the company.

4. Publication in the official newspaper of Cyprus that the company has been struck off the Register.

This entire procedure can take from several months to a year.

Is it possible not to pay taxes and fees on an abandoned company in Cyprus

It is necessary to keep in mind that in order to avoid objections to the strike-off from the Cyprus tax service, the company is obliged to pay all taxes due on the date of signing the decision to close the company by the directors.For this purpose, the company must undergo an audit and receive a corresponding conclusion.

Is it possible to restore a company struck off from the Cyprus register

After striking off from the Register, the company can be restored to the register of companies operating for 20 years from the date of striking off.To do this, any shareholder or creditor of the offshore company must apply to the court.

Our lawyer in Cyprus can both organize the liquidation of the company and restore it.

Order other certificates of companies in Cyprus

Certificate of Good Standing:

enlarge

enlarge

Memorandum and Articles of Association:

enlarge

enlarge

Certificate of Directors and Secretary:

enlarge

enlarge

Certificate of Registered Address:

enlarge

enlarge

Certificate of Shareholder Capital:

enlarge

enlarge

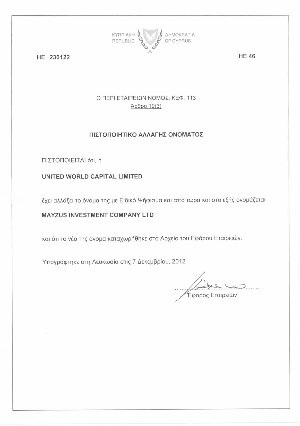

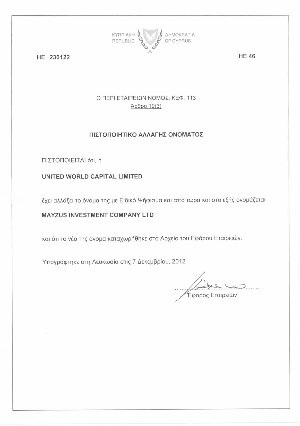

Certificate of changes the name of the company:

enlarge

enlarge

Certificate of Solvency or non-bankruptcy:

enlarge

enlarge

Can you translate the certificates ?

Yes, we can.

Can you make Apostille on non-bankruptcy Certificate?

Yes, we can.